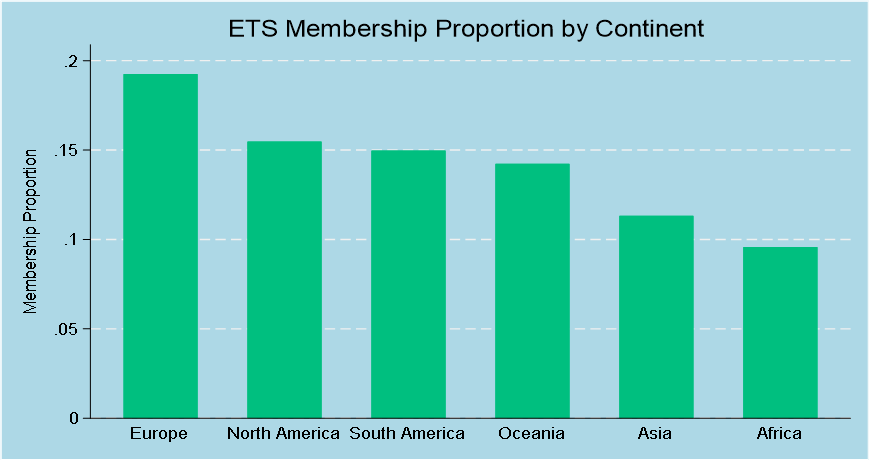

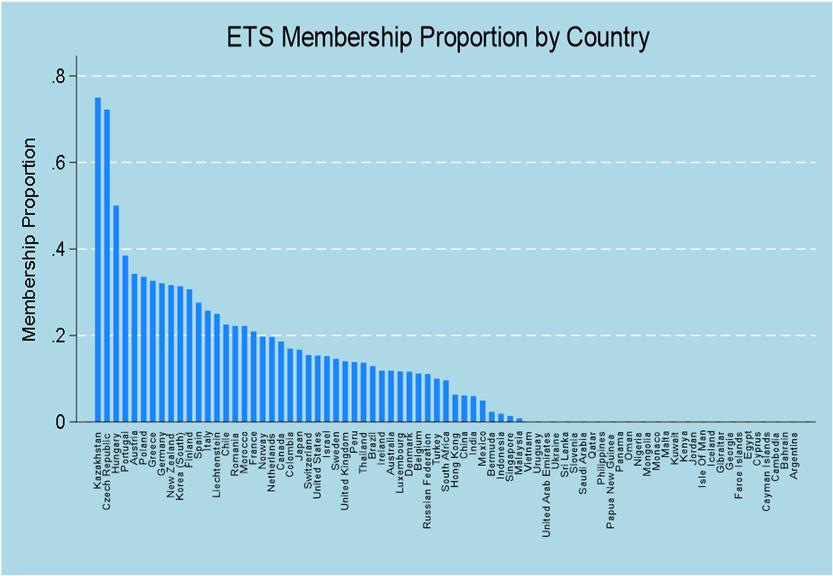

In our recent study in Business Strategy and the Environment, we sought to establish the influence of CEO power on the decision to take part in an emissions trading scheme (ETS). We use CEO duality, i.e., whether the CEO is also the chairman of the board as our proxy for CEO power. Duality is almost extinct in the UK due to corporate governance codes but is still prevalent, although falling in the USA. About 40% of US CEOs are also the chair according to recent data. This gives dual CEOs considerable power over decision-making in companies in which such a structure is present. Our study examines whether this power results in lower engagement with ETSs across a large sample of global companies. Figure 1 and Figure 2 show the prevalence of ETS membership across continents and countries.

Figure 1

Figure 2

The purpose of emissions trading schemes is to limit the greenhouse gas emissions allowed within a sector of an economy. Over a pre-determined period, members of the scheme can buy or trade allowances which are used to cover their emissions. At the end of the measurement period, member companies must surrender the correct number of allowances to cover their emissions. Failure to do so can lead to significant penalties, such as fines and regulatory intervention as well as an ongoing requirement to surrender allowances.

It has become clear in previous studies of CEO power is an important factor influencing corporate engagement with climate mitigation (Al-Shaer et al., 2023; Francoeur et al., 2021). One aspect of this behaviour that has received less attention is the role of CEO duality on corporate climate actions. In particular, our study seeks to establish how CEO structural and board discretionary power dynamics shape the decision to adopt climate mitigation strategies within firms and across a range of jurisdictions. Extant works have not provided practitioners and policymakers with guidance on structuring corporate leadership to address sustainability challenges effectively (Walls & Berrone, 2017). We are motivated to provide such guidance.

To answer our research questions, we utilised a large sample of firm-level environmental and corporate governance data from multiple regions and legal origins. The results show that firms led by dual-role CEOs are less likely to join emissions trading schemes. Digging deeper into the factors that influenced our results, board structure variables, such as board tenure, board size, board nationality mix, and proportion of independent directors are found to moderate the impact of CEO decisions to join an ETS. Stronger governance is associated with greater membership of an ETS.

A notably finding is that the continent of operation and the legal tradition in which the firm operates affect the core relationship. In African companies, where common law is less prevalent, dual CEOs are more likely to join an ETS, whilst, in common law jurisdictions, ETS membership is less common when CEOs are more powerful.

Financing frictions and growth opportunities also affect the relationship between CEO duality and ETS membership. The likelihood of dual CEOs joining an ETS is more pronounced among firms that are financially less constrained and have high growth opportunities.

Our study provides important empirical evidence on the role of CEO power, defined as CEO duality, in shaping corporate climate strategies. The results address the critical gap in the literature on the key factors shaping the decision by dual CEOs to participate in emission trading schemes across different regions and legal systems. The practical implications for corporate governance reforms include designing governance structures that promote effective climate action and encourage ETS membership. Corporate leadership can hinder the adoption of carbon mitigation initiatives, such as emission trading schemes. By identifying the conditions under which CEO power can influence the climate mitigation policies, we provide important guidance to boards, regulators, and investors seeking to engage with a corporate sustainability agenda. Where firms are subject to environmental disclosure or decarbonisation obligations, we suggest regulators should consider discouraging CEO duality or mandating board independence thresholds to limit CEO power.

Edward Jones, Finance

Full paper is here: Adekunle, I. A., Adamolekun, G., Jones, E., & Bolarinwa, S. T. (2025). Dual Role Executives and Corporate Membership of Emission Trading Schemes: The Role of Board Structure. Business Strategy and the Environment., https://doi.org/10.1002/bse.70265